Our Services

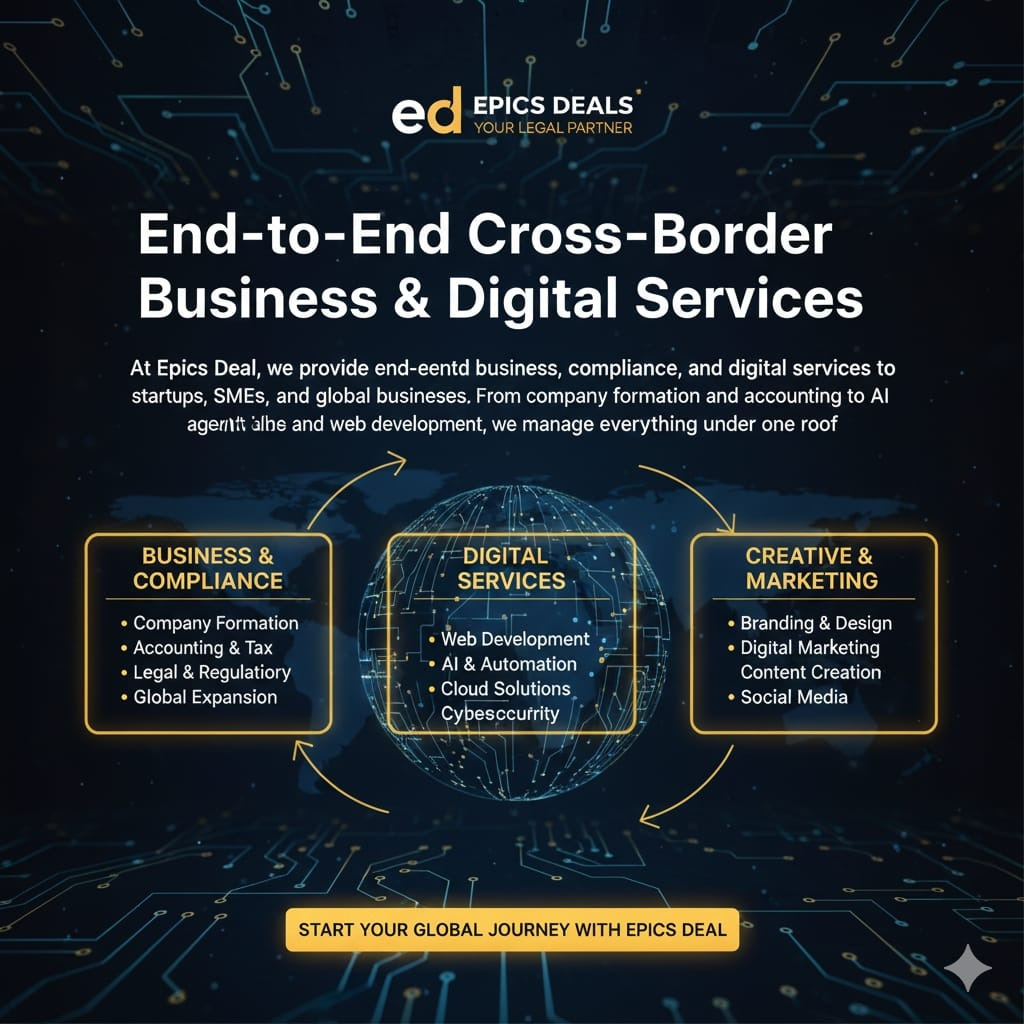

End-to-End Cross-Border Business & Digital Services

At Epics Deals, we provide end-to-end business, compliance, and digital services to startups, SMEs, and global businesses. From company formation and accounting to AI agents and web development, we manage everything under one roof.

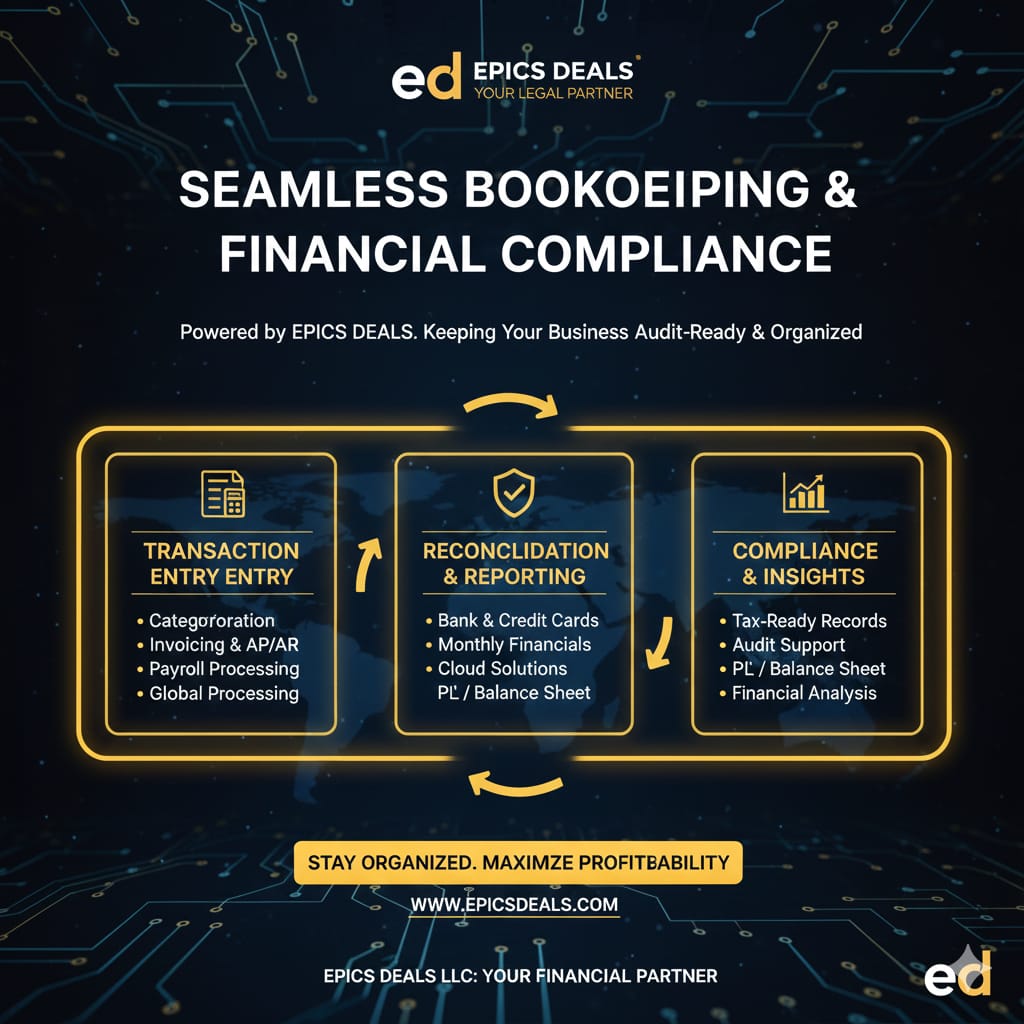

Bookkeeping Services

We provide reliable and accurate bookkeeping services to help businesses maintain clean financial records and stay audit-ready.

What’s Included:

Daily / monthly bookkeeping- Expense & income tracking

Reconciliation - Financial records management

- Multi-currency bookkeeping

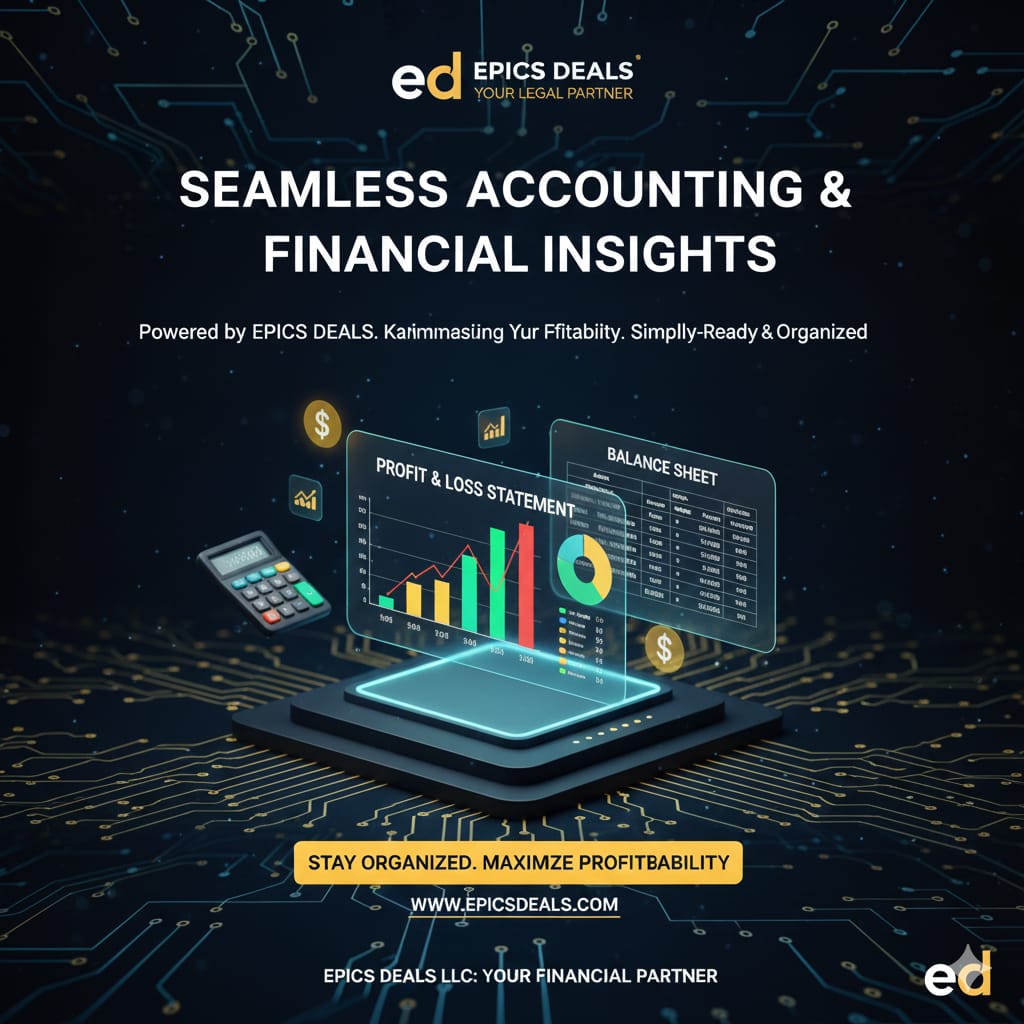

Accounting Services

Our professional accounting services help businesses manage finances, reporting, and decision-making efficiently.

What’s Included:

Financial statements

Profit & loss reporting

Balance sheets

Cash flow analysis

Management accounting

Taxation Services

We handle local and international taxation so your business remains compliant and tax-efficient.

What’s Included:

Corporate tax filing

VAT / GST registration & returns

International tax compliance

Tax planning & advisory

LLC / Company Formation

We assist with LLC and company formation across multiple countries with full legal compliance.

What’s Included:

LLC & company registration

Offshore & overseas company setup

Documentation & licensing

Business structure advisory

LLC / Company Dissolution

We manage the legal closure and dissolution of companies smoothly and compliantly.

What’s Included:

Company strike-off

Legal documentation

Tax clearance

Regulatory filings

AI Agent Development

We build custom AI agents to automate customer support, sales, operations, and internal workflows.

What’s Included:

AI chatbots & assistants

CRM & workflow automation

AI for customer support & sales

Custom AI solutions

Bank Account Opening Assistance

We assist businesses with corporate bank account opening for local and international entities.

What’s Included:

Corporate bank account setup

Documentation support

Compliance & KYC assistance

Multi-country banking support

Compliance Services

We ensure your business meets all regulatory and statutory compliance requirements.

What’s Included:

Annual filings & renewals

Regulatory reporting

Corporate compliance monitoring

Legal compliance support

Trademark Registration

Protect your brand with our trademark registration services.

What’s Included:

Trademark search & filing

National & international trademark registration

Documentation & follow-ups

Web Development Services

We design and develop SEO-friendly, high-converting websites for businesses and startups.

What’s Included:

Business websites & landing pages

SEO-optimized development

Mobile-responsive design

Performance & speed optimization

Other Business Services

Need something custom? We provide tailored business solutions based on your requirements.

ITIN Services

We assist individuals and businesses with ITIN application and processing.

What’s Included:

ITIN application support

Documentation preparation

IRS compliance assistance

📞Get Started Today

Looking for company formation, taxation, accounting, compliance, AI automation, or web development?

Epics Deals is your trusted partner.

FAQ

How much does it cost to form an LLC?

Formation fees are determined by the state, not the federal government, so *fees vary from state to state

Which states are the most cost-effective for non-residents?

For startups looking to minimize overhead, *Missouri* and *New Mexico* are currently the most affordable options. They offer the lowest initial filing fees and some of the most competitive annual maintenance expenses for non-resident owners.

Do annual expenses stay the same across the US?

No. Each state has its own requirements for annual reports and franchise taxes. We help you choose a state that aligns with your long-term budget.

When does the tax filing season officially begin?

The IRS typically begins accepting tax filings on January 15 every year.

What should I do with an unused LLC?

If your LLC is no longer in use, you should *dissolve it legally* via our platform. This prevents the accumulation of state fees and penalties on an inactive entity.

What if I cannot file my taxes by the deadline?

If you are not ready to file, you can apply for an *Extension. Filing for an extension allows you extra time to submit your paperwork and is a critical step to **avoid hefty penalties* for late filing.

What are the risks of non-compliance?

Failing to file or filing late can lead to *hefty financial penalties* and may jeopardize your business’s “Good Standing” status, which could impact your ability to operate or access banking.

Are there specific deadlines for states like Texas or Florida?

Yes, states have their own mandatory filing schedules:

– Florida Annual Report:* Due by *May 1st* each year.

– Texas Franchise Tax:* Due by *May 15* each year.

Our platform tracks these dates for you to ensure you never miss a deadline.

How long does ITIN approval take?

Approval typically takes *3 to 5 months*. This number gives you legal access to the US tax system, which is essential for non-residents to build a credible business empire.

How does legal structure help with client acquisition?

Correct legal setup and professional branding build *credibility*. In business, credibility leads directly to trust, and trust is the primary driver of client acquisition.